Most of the advertisements talk about how that business has the best cost. We built a car insurance coverage calculator so you can understand what's a reasonable price. Remarkably, the expense or insurance coverage can, and does, differ significantly.

Just click the button below. Insurance rates differs a lot by state. We constructed a car insurance coverage calculator for each of the 50 states. Val, Option does not get paid to rate insurance provider. We do this as a service to customers.

Every insurance provider desires your business, however how can you tell which to opt for for your cars and truck insurance coverage? If you desire to find the finest automobile insurance coverage, it may take a little research study and mindful consideration. In this guide, we'll show you how to compare various rates and companies, go over elements that can affect your vehicle insurance quotes, and supply a list of advised contrast sites that will shorten the time it takes you to discover the finest car insurance provider.

There are various methods to go about this, and each strategy might offer differing results. What pre-owned to work in the past may not be the most efficient approach anymore. Here are a few methods you can compare vehicle insurers and their rates: 1. Research study private insurance service providers Pulling up a specific insurance provider's site is normally simple to do on your phone, computer, or other device.

When you have actually completed taking a look at one provider's site, you can move onto the next and do more research study with them. It's a simple method and seems easy enough, however this process can be lengthy. auto insurance. To get a quote from an insurance service provider, you have to input all your info and perhaps your partner's info.

In addition, it can get confusing taking a look at various supplier websites. Terms is not standardized throughout the insurance industry. The terms business utilize for certain protections may be various, even if they mean the same thing. This can make it tough to understand just what is being used by each business.

Finding the exact vehicle insurance policy that's right for you can take a while and may cost you more in time than it saves you because you most likely haven't heard of every single company out there. 2. Go to an insurance coverage agent Insurance coverage representatives can be an useful resource for cars and truck insurance coverage information because they're the experts on the subject? It's true, they ought to understand what they're talking about, however that doesn't indicate you're going to have an unbiased interaction with an agent.

Getting My The Best Car Insurance In 2022 - Benzinga To Work

It's in their benefit to do so since that's who they work for. This won't help you if you're trying to compare all the available alternatives. If you meet with an independent insurance coverage agent, you'll at least get a take a look at rates from several insurance provider - accident. However, the representative will still be encouraged to sell you something from what they have to provide since that's how they make money.

It's also not the most practical to establish a conference with a representative when you're uncertain if it'll deserve your time. If you wish to get the facts from every company about what they provide, you 'd have to fulfill a private representative from each business or deal with an independent agent.

In general, this technique might have made sense in the past, however now it appears out-of-date and inefficient. Car insurance coverage comparison websites are generally the simplest and most comprehensive technique of comparing vehicle insurance coverage companies and rates (affordable car insurance).

You can then look at the various offers and compare them (car). In a method, this is the exact same method as looking up private insurance provider yourself, other than much quicker. You only need to fill out your information one time, and then the comparison site instantly fills out the types on each business's website for you.

Our recommendations for the best automobile insurance comparison sites Vehicle insurance coverage comparison sites supply a basic and uncomplicated way to easily check out quotes and protections from different insurance coverage companies. If you were to go to each specific insurance coverage website yourself to do research, it would take a lot more time.

Here are our suggestions for the very best vehicle insurance coverage contrast sites: Quote Wizard Quote Wizard is a straightforward comparison website that simplifies the procedure of comparing cars and truck insurance quotes - car insurance. In just minutes, you could be on your way to the best car insurance coverage rate and protection you've ever had. There's nothing tough about Quote Wizard's procedure.

There's no expense for these services, and companies consist of State Farm, Allstate, Farmers, Progressive, and Liberty Mutual. The Zebra The Zebra uses quotes from over 100 suppliers and says you can conserve up to $670 a year by utilizing their services. For how quick they pull up rate quotes for you, that's a great deal of possible savings.

The Best Guide To Best Car Insurance Reviews - Consumer Reports

Once you've quickly constructed your profile, Supply will find the most relevant choices for you based on the information you offered. There's no cost to utilize Offer Insurance's services, and there's no pressure to go with any specific business.

When comparing quotes, it's essential you compare the exact very same cars and truck insurance coverage in between various service providers. For instance, you'll desire to make sure the accident protection is for the exact same amount or has the same deductible. This is important since one company may appear like it's offering low-cost car insurance, however if they don't offer the very same protection, it's not a reasonable comparison. cheapest car.

Here are the crucial things to think about when you're taking a look at a car insurance plan: The quantity you pay out of pocket before insurance coverage kicks in. Covers you if your automobile remains in an accident, including with another lorry, a things, or by itself (such as a rollover). Covers theft, vandalism, or damage to your vehicle that isn't covered by collision insurance.

May cover rehab costs and lost earnings too. May likewise be called other things by the service provider, however it generally suggests guaranteeing the distinction or some portion of the difference in between what you owe on an auto loan and what your automobile is in fact worth. Usually covers any costs required if you break down, such as towing, battery jump-start, flat tire change, and more.

Depending on your personal choices, you might likewise wish to investigate any advantages or advantages that come with an insurance policy from a specific business. For instance, some business have great mobile apps, while others do not. Lastly, as part of your research study, be sure to take a look at customer insurance coverage reviews and client complete satisfaction ratings of any supplier you're considering.

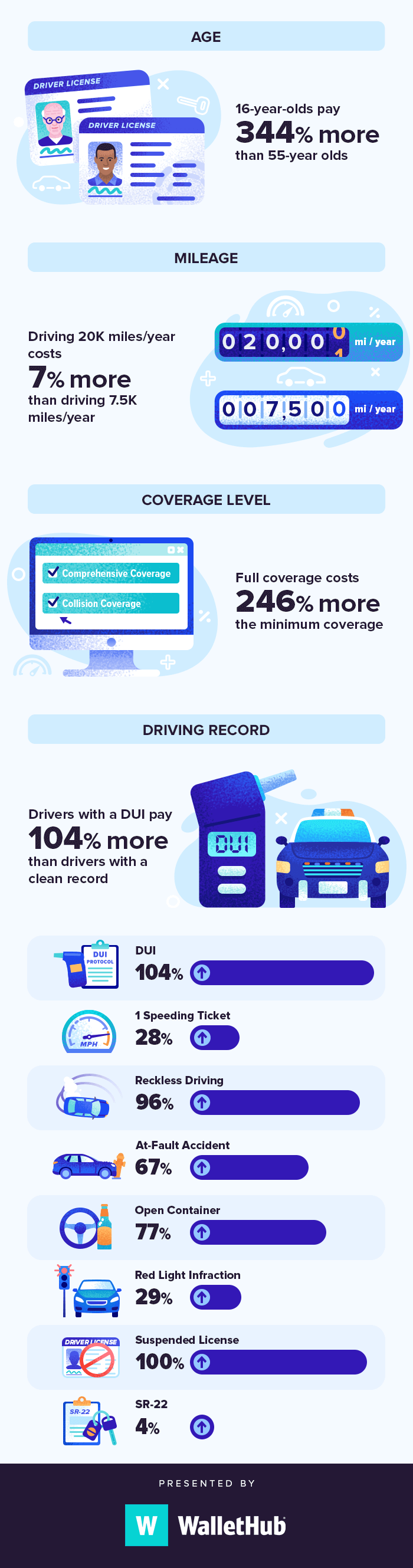

Here are some of the significant elements that impact cars and truck insurance rates: Those with a great driving record might get a lower rate at-fault accidents and traffic infractions will increase your rates. cheapest car. Good driver discounts might decrease your premium. The more pricey your car, the higher your rates will be.

A good credit rating will help you get lower rates. If you drive more, your rates may be greater.

Low Cost Car Insurance 2021 - Youtube Can Be Fun For Anyone

For the quickest and most efficient way of finding the best rates, utilize an automobile insurance coverage contrast site. This will take the inconvenience out of searching through different insurance coverage items and spending a lot of time to find your responses.

Rate comparisons provided here are based on our Progressive Direct vehicle insurance coverage cost and item, and do not consist of prices and products offered from Progressive agents. Call Your Price is readily available in a lot of states for brand-new policies. Cost and coverage match restricted by state law. Amounts got in beyond our range of coverage rates will be revealed the closest readily available coverage package.

Each insurer is exclusively accountable for the claims on its policies and pays PAA for policies sold. PAA's compensation from these insurers might differ in between the insurance providers and based on the policy you purchase, sales volume and/or success of policies sold.

efforts to estimate each applicant calling us for a quote with a minimum of among these insurance companies by utilizing its Entrepreneur, General Liability, Expert Liability and Workers' Compensation quoting standards for the candidate's state. suvs. These guidelines will identify the business priced estimate, which might differ by state. The business estimated might not be the one with the lowest-priced policy readily available for the applicant.

Protection subject to policy terms and conditions. insurance company.

Entering an accident, particularly if you're at fault, will likely lead to higher rates in the future. Some business, such as Allstate and Farmers, may provide accident forgiveness that prevents an accident from increasing your rates. USAA, GEICO and State Farm may provide the most affordable rates if you have not been in a mishap or have actually remained in one at-fault accident.

Finest Vehicle Insurance Coverage Rates for Young Motorists, As anybody who's included a teenager to their vehicle insurance coverage can tell you, young motorists tend to be costly to guarantee. Rates drop as you age, and can level out as soon as a driver is in their mid-20s (money). If you're a young adult (or somebody covered by your policy is), you might want to purchase new quotes after every birthday.

8 On Your Side: Car Insurance Premiums Increases - Klas for Dummies

Amongst the more standard insurance provider, USAA, State Farm and GEICO may provide the most affordable rates. However often, there won't be a big distinction unless you go with a usage-based policy. Best Vehicle Insurance Rates Based on Your Credit, In most states, credit-based insurance scores can be a consider determining your vehicle insurance premiums.

At a minimum, many states require drivers to have liability protection, which pays for others' medical expenses and damage to their home. You may also need to acquire medical protection or individual injury protection, which can assist spend for your (and your travelers') healthcare. If you desire protection in case your lorry is harmed or taken, you'll require crash protection (for damage from accidents) and comprehensive protection (for theft and damage brought on by something aside from a collision, such as a storm).

Nevertheless, it's a tradeoff as more coverage and lower deductibles also result in greater premiums. How to Get the very best Rates on Your Automobile Insurance No matter which types of coverage, limitations and deductibles you select, there are a couple of methods to save cash on car insurance coverage: There's no insurance provider that offers the very best rate for everybody. insure.

As a result, improving your credit could help you receive much better rates. Some insurer, such as Liberty Mutual, provide a discount rate if you buy your coverage online. Progressive and Elephant Insurance even give you a discount rate if you get a quote online and buy the policy with an insurance coverage agent. You won't always find a savings chance, however the elements that identify your rates, your insurance needs and the companies' offering and preferences can all change over time.

Protection subject to policy conditions. cheapest car insurance.

Getting into an accident, particularly if you're at fault, will likely lead to higher rates in the future. USAA, GEICO and State Farm might offer the most affordable rates if you haven't been in a mishap or have been in one at-fault mishap.

Best Auto Insurance Coverage Rates for Young Drivers, As anybody who's added a teenager to their auto insurance can tell you, young chauffeurs tend to be pricey to insure. Rates drop as you get older, and can level out when a chauffeur is in their mid-20s. If you're a young adult (or someone covered by your policy is), you might desire to purchase new quotes after every birthday. cheaper car.

A Biased View of Best Car Insurance Companies In California - Cars.com

Among the more traditional insurance coverage business, USAA, State Farm and GEICO may offer the lowest rates. Typically, there will not be a big distinction unless you go with a usage-based policy.

At a minimum, a lot of states require chauffeurs to have liability protection, which spends for others' medical expenses and damage to their residential or commercial property. You might also need to acquire medical coverage or accident protection, which can help spend for your (and your guests') healthcare. If you want coverage in case your lorry is damaged or stolen, you'll require collision protection (for damage from accidents) and extensive coverage (for theft and damage triggered by something besides an accident, such as a storm).

However, it's a tradeoff as more coverage and lower deductibles also lead to greater premiums. How to Get the Finest Rates on Your Vehicle Insurance coverage No matter which types of protection, limitations and deductibles you choose, there are a couple of methods to save money on vehicle insurance coverage: There's no insurer that uses the best price for everybody.

As an outcome, improving your credit might help you receive better rates. Some insurer, such as Liberty Mutual, use a discount rate if you buy your coverage online. Progressive and Elephant Insurance even provide you a discount rate if you get a quote online and purchase the policy with an insurance agent - cheapest car insurance. You won't always find a savings chance, however the elements that determine your rates, your insurance coverage requires and the business' offering and choices can all alter in time.