In a lot of markets, when you're not at mistake for a mishap, we can forgo the deductible if we can identify the various other celebration, that they're at fault, as well as their insurance policy provider confirms they have legitimate responsibility protection for the crash. low-cost auto insurance. This investigation can take some time, so the insurance deductible might use at the beginning of the insurance claim and be repaid later on.

Your insurance deductible just applies when your insurance provider spends for your automobile repair services. There is no insurance deductible if the other event's insurance is dealing with the repairs. The deductible only relates to https://s3.ap-southeast-1.wasabisys.com your very own automobile repair services. There is no insurance deductible for the various other event's vehicle repair services under your policy. Your cases service representative will send you a reimbursement look for your insurance deductible.

If you utilize the standard mileage price, you can not deduct automobile insurance coverage premiums as a different expenditure. This includes auto insurance and also the other items provided above.

Many individuals utilize an individual car for both personal as well as organization functions. To figure out what uses to your tax obligations, you'll separate the costs between individual as well as company use based upon the miles that you drive. If 70% of the miles you drive are for company, as well as the various other 30% are for individual, you'll typically be able to apply 70% of your expenditures to your reduction.

Find a Store Get in postal code to locate a shop near you. insurance company.

Some Known Details About Auto Insurance Claims Faq - Amica

"Recognizing Automobile Insurance: Leading The Way" is the 7th video clip in the Federal Get Financial Institution of St. Louis collection, "No-Frills Cash Skills." This episode uses a radio talk show style to discuss various aspects of automobile insurance coverage. car insured. From the reactions to concerns from customers, students find out a number of crucial principles and also terms associated to vehicle insurance policy.

If you are at-fault in a crash, the insurance policy company will only pay for the damages to your cars and truck IF you have acquired collision insurance coverage. A deductible amount is used initially, then the insurance business pays.

Carol, you'll have to turn your radio down. My concern is; if I acquire accident insurance coverage for when I harm my very own cars and truck, as well as I purchase obligation insurance coverage for when I damage a person else's auto or cause injury. What if somebody hits me, I'm injured, and also they do not have insurance policy?

If you've currently experienced a case, you've most likely learned how your deductible works first hand. For those who haven't, it can cause confusion about just what a deductible is and that pays for it. What a deductible is A deductible is the amount of money you (the named insured on the plan) pays out of pocket for the cost of problems before the insurer pays.

low-cost auto insurance prices cheaper car insurance

low-cost auto insurance prices cheaper car insurance

Your insurance coverage business will certainly pay the remaining equilibrium of $500 to the garage. Because you have actually selected a $500 deductible, you will be responsible for the expenses.

The Ultimate Guide To Everything You Need To Know About Your Car Insurance ...

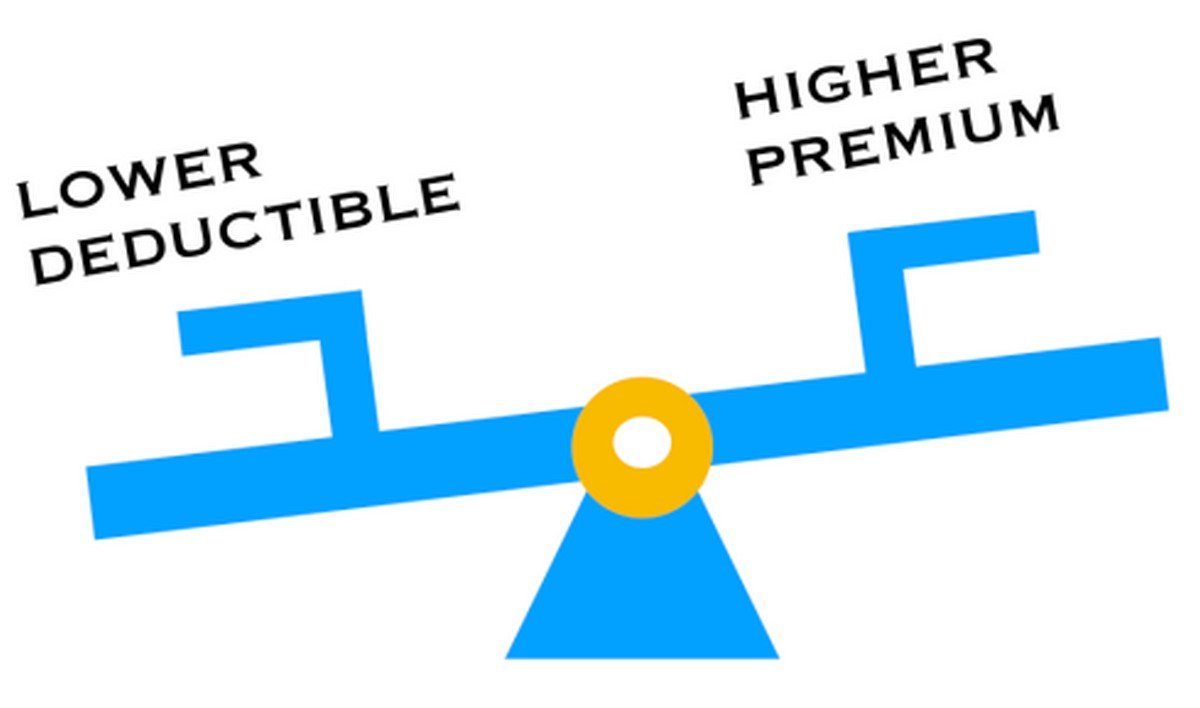

While the amount of your insurance deductible can increase or decrease your premium, insurance deductible and premium are two different points. The called guaranteed on the plan is liable for paying the insurance deductible quantity.

This implies that even if a person else was driving your cars and truck and got right into an accident, your insurer would deal with the claim as well as you would certainly be accountable for your plan insurance deductible. It's not the like a health and wellness insurance deductible. Deductibles for medical insurance policies commonly cover an entire one year, implying you would just compensate for your deductible (i.

Nevertheless, an auto insurance coverage deductible uses "per event." This implies you are accountable for your full insurance deductible amount each time you suffer a protected loss - cheapest car insurance. Similar to all points insurance, it's best to go over deductibles and also how they apply in your circumstance with a regional independent insurance representative. Your neighborhood independent agent has the knowledge and also experience to answer often asked inquiries regarding deductibles and also determine cost financial savings for you relying on the deducible amount you pick.

Discover what a vehicle insurance deductible is as well as just how it impacts your automobile insurance policy coverage. auto. Cars and truck insurance all of us recognize we require it. However beyond that, a number of us still ask ourselves, "What car insurance policy should I get?" The key is understanding what deductibles as well as coverages are and exactly how they influence vehicle insurance coverage.

What is a deductible? In other words, a deductible is the amount that you accept pay up front when you make an insurance coverage case, while the insurance provider pays the remainder as much as your coverage restriction. When selecting your cars and truck insurance policy deductible, think of how much you're willing to pay out of pocket if you require to make an insurance claim.

The Basic Principles Of Understanding The Car Insurance Deductible - Snntv.com

It truly comes down to what makes you the most comfortable. Car insurance plans usually include a number of type of protections. Because insurance policy laws vary from state to state, the following information is below to offer you a broad summary of regular protections, as well as it isn't a statement of contract.

Uninsured driver This insurance coverage pays for damages if you or one more covered person is hurt in a car accident created by a chauffeur who does not have liability insurance policy. In some states, it may additionally pay for residential property damages. The coverage varies by state and also depends upon plan stipulations - suvs. Without insurance driver insurance coverage goes through a policy limitation picked by the insured.

Underinsured motorist protection is subject to a policy restricts chosen by the insured. Rental compensation This coverage pays for rental expenditures if your auto is impaired due to a protected loss. cheap.

A deductible is what you pay out of pocket to fix your vehicle before your cars and truck insurance pays for the rest. If you bring extensive and also collision protection on your auto insurance policy, you will see a deductible listed on your plan as a buck amount.

When do you pay your insurance deductible? You only pay the deductible for fixings made to your very own lorry.

Getting My Collision Coverage - Geico To Work

How a lot will you conserve yearly on costs? Would certainly these cost savings make a meaningful influence on your budget plan? This is where the value of your cars and truck can be a large aspect. For instance, more recent cars are extra pricey to replace than older automobiles. For that reason alone, you may see a large cost enter your premium if you go with the reduced insurance deductible.

If you're still leaning toward a greater insurance deductible, assume concerning this: Exactly how long would certainly it take to redeem what you'll invest on premium expenses? If it's just mosting likely to take you a year or 2, the greater deductible may still be looking great. Or else, the reduced insurance deductible might make more sense - accident.

Consider how you utilize your car. Where do you live? Where do you drive to? Where do you park? If you live in a peaceful neighborhood with a quick commute to work, you might be comfy with a greater deductible. In the long run, it's your call. Be sure as well as speak with your ERIE representative to assist you establish which plan is appropriate for you.

The money we make aids us offer you access to free credit report as well as reports and assists us produce our various other wonderful devices and instructional materials. Settlement might factor right into exactly how as well as where items appear on our platform (as well as in what order). Given that we usually make cash when you discover an offer you like as well as obtain, we try to reveal you offers we believe are a good match for you.

Certainly, the deals on our system don't represent all financial products available, yet our objective is to reveal you as several wonderful options as we can (cheap car). Confused regarding how an auto insurance policy deductible jobs? When buying for cars and truck insurance coverage, you'll likely stumble upon words "insurance deductible" and also could ask yourself just how it affects you and your insurance coverage expenses and when you'll in fact need to utilize it.

The smart Trick of Deductibles In Car Insurance: Voluntary And Compulsory - Acko That Nobody is Discussing

Typical vehicle insurance coverage deductible quantities are $250, $500 and also $1,000. Fixings amounted to $5,000, and you have a $500 deductible.

An automobile insurance policy deductible isn't a single amount that you pay annually prior to services are covered, like you'll typically find with health insurance policy deductibles. Basically, it relies on where you live (suvs). In most states, if you're in a mishap that's the other driver's mistake, their responsibility insurance policy is typically in charge of covering your repair services, approximately the insurance coverage limitation.

A vehicle insurance coverage deductible is the quantity you consent to pay of pocket for an insurance claim before your policy pays the rest. Maintain reading to get more information about car insurance deductibles, consisting of: Exactly how a cars and truck insurance deductible jobs Some types of automobile insurance require you to pay a collection quantity out of pocket before the policy covers the remainder of the insurance claim.

If you have a $500 insurance deductible, you pay $500, then your vehicle insurance policy business pays the remaining $6,500. When do you pay a deductible for vehicle insurance policy?

: covers damage as a result of reasons apart from accident, consisting of burglary, criminal damage and fire. An uninsured/underinsured vehicle driver insurance policy claim may have an insurance deductible, depending on where you live. Uninsured motorist coverage deductibles tend to be controlled by your state as opposed to you selecting the amount. Vehicle responsibility insurance policy covers problems as well as injuries you cause to other individuals or their home.

Not known Details About Deductibles In Car Insurance: Voluntary And Compulsory - Acko

Do I pay an insurance deductible if I'm not at fault? If you are in a collision that is not your mistake, you typically won't pay a deductible.

If you require to speed points up, sue with your insurance company for crash insurance coverage. You will need to pay your deductible in this circumstances, yet if it's later discovered that you're not responsible for the mishap, you can get a refund. There are a number of other opportunities that may take place: Your insurance company may decide to go after activity versus the other vehicle driver's service provider to recover their expenses.

cars car insurance insurance companies car

cars car insurance insurance companies car

money business insurance insurance affordable auto insurance

money business insurance insurance affordable auto insurance

If you are not able to recover your insurance deductible from your carrier, you can take the other chauffeur to tiny cases court for the insurance deductible amount. Bear in mind, however, that the deductible quantity may unworthy the moment. Auto insurance coverage deductible vs. superior Deductibles as well as premiums are two kinds of payments you make to your car insurer for insurance coverage.